portability of estate tax exemption 2020

The 2020 increases to the estate tax exemption also impact the portability of the exclusion from a deceased spouse to their surviving spouse. The exemption is subtracted from the value of estate assets with the result being subject to the estate tax.

Portability Of The Estate Tax Exemption Cdh Law Pllc

Like last year surviving spouses can only take advantage of portability if the spouse who passed.

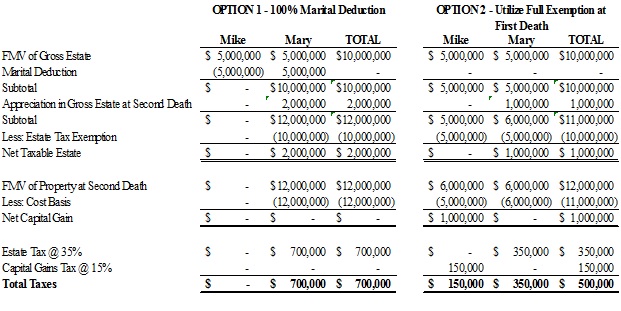

. And then after one spouses death then the surviving spouse can take steps to combine their estate tax exemptions to reduce estate tax. When Mark dies in 2020 his estate is still worth 20 million since he inherited 100 of the rights to the assets upon Joans death he must pass down an estate worth 20 million. It allows the spouses to go about their estate planning and transfer assets upon their death the way that they would like to to carry out their wishes.

Determine how much of the estate tax. When the surviving spouse later dies or makes a lifetime gift the surviving spouse will have his or her own exemption 5000000 in 2011 and 2012 plus the unused exemption of his or her deceased spouse to offset the estate or gift tax. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013 5340000 in 2014 and 5430000 in 2015 federal estate tax exemption then the surviving spouse can make an election to pick up the unused exemption and add it to the.

As you know the 2020 estate and gift tax exemption amount is 11580000 per person and as a result of this extremely high level very few people are subject to estate and gift taxes. The exemption is in fact indexed annually for inflation so it does increase over time. The federal estate tax exemption is however indexed for inflation and does therefore.

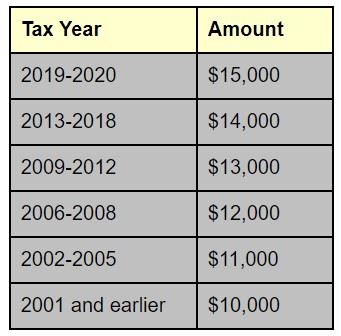

The Illinois exemption is only 4000000 per person so some clients may have Illinois estate taxes even though they are not required to file a Federal estate tax return. 1 Congress repealed the estate tax for 2010 but then gave taxpayers the option to opt in to the estate tax regime with steppe-up basis or opt out and. Portability allows a surviving spouse to apply a deceased spouses unused federal gift and estate tax exemption amount toward his or her own transfers during life or at death.

The key advantage of portability is flexibility. At the time of this writing in 2020 the federal estate tax exclusion is 1158 million. In 2020 the NYS estate tax exemption amount is set at 585 Million adjusted for inflation.

Estates valued above the threshold may be taxed on a. The federal estate tax exemption will allow you to avoid some taxation as the exemption amount is subtracted from the value of the estate and only the remaining amount will be subject to the federal estate tax. However if the husbands estate had filed an estate tax return and made the election to transfer the DSUE the wifes exemption would be 16 million the DSUE of 11 million plus her exemption of 5 million and no estate tax would be due.

2017-34 may seek relief under Regulations section 3019100-3 to make the portability election. Its 1158 million for deaths occurring in 2020 up from 114 million in 2019. The estate tax exemption for 2020 is 1158 million per decedent up from 114 million in 2019.

The surviving spouse would therefore be able to shield 228 million from the 40 federal estate tax when it passes to heirs upon death instead of 114 million. Note that when using EFTPS you will not use the table of codes listed below. It sat at 114 million for 2019 1158 million for 2020 and it has now hit 117 million for 2021.

How does the Federal Estate Tax Exemption work. The federal estate tax exemption is indexed for inflation so it increases periodically usually yearly. The federal tax exemption in 2020 was 114 million which leaves 86 million subject to 40 tax without portability rules.

Thus for the first time unused exemptions can be transferred between spouses. For individuals passing away in 2017 the estate tax is the tax applicable to any amount in the decedents estate over the Federal estate tax exemption of 549 million per person. The portability of a deceased spouses unused estate tax exemption is an important concept and is even more so in 2020 which is a pivotal year in so.

If you have need assistance with using EFTPS contact EFTPS Tax Payment Customer Service at 800-555-4477 Businesses or 800. Her estate will owe 18 million in estate taxes 9 million less 5 million times 40. This means that the exemption moved up to 1118 million per person for the years 2018 through 2025.

With exemption levels being indexed for inflation the exemption amount has gone up still. 6 Thus without the New York legislature intervention there is a large taxation discrepancy between New York estate tax rates and Federal estate tax rates. The good news is that there is a credit or exclusion that allows you to pass along a certain amount of property free of taxation and it is quite high.

This is the amount a person can leave their heirs without paying federal estate taxes and which is annually indexed for inflation. The IRS increases the federal estate tax exemption each year to account for inflation. This a good question but whether it is fair or not the federal estate tax is a fact of life.

For 2020 the exemption amount is 1158 million and the IRS just announced that that amount will increase to 117 million for 2021. In reality very few estates will pay estate tax. Its basically 11 million plus inflation adjustments4.

Please note that these exemption amounts are for. In 2019 the federal estate tax exemption was at 114 million. As previously discussed portability refers to a spouses ability to claim unused exclusion amounts from the spouse who died.

November 5 2020. Any estate that is filing an estate tax return only to elect portability and did not file timely or within the extension provided in Rev. There is no fee to use EFTPS.

May 1 2020 Estate Taxes Many of you already know that under the 2010 Tax Act surviving spouses can take advantage of their deceased spouses unused federal estate tax exemption. Taxable estates that exceed the exemption amount will have the excess taxed at a flat 40 rate. Portability of Estate Tax Exemption On Behalf of Griffin Van Pelt PA.

As of 2021 the federal estate tax exemption is 114 million.

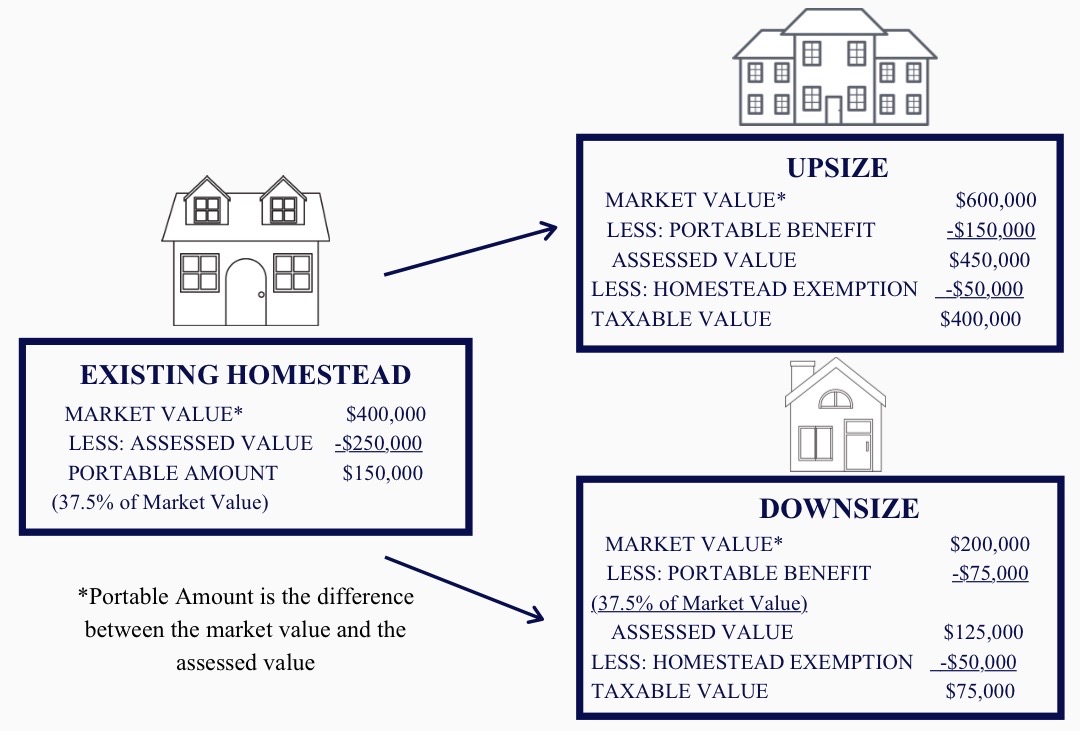

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Usda Ers Less Than 1 Percent Of Farm Estates Owed Federal Estate Taxes In 2020

Estate Tax Portability Preserving It For The Benefit Of Your Heirs

Property Tax Portability Jennifer Sego Llc

If You Sell Investments You Ve Held For More Than A Year Here S What It Means For Your 2020 Tax Bill Tax Deductions Capital Gains Tax Tax Preparation

Federal Estate Tax Portability The Pollock Firm Llc

Is It Too Late To Elect Portability Burner Law Group

Estate Tax Portability What It Is And How It Works

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp

Understanding Qualified Domestic Trusts And Portability

Mastering Portability Ultimate Estate Planner

Deceased Spousal Unused Exclusion Dsue Portability

Estate Tax Portability Preserving It For The Benefit Of Your Heirs

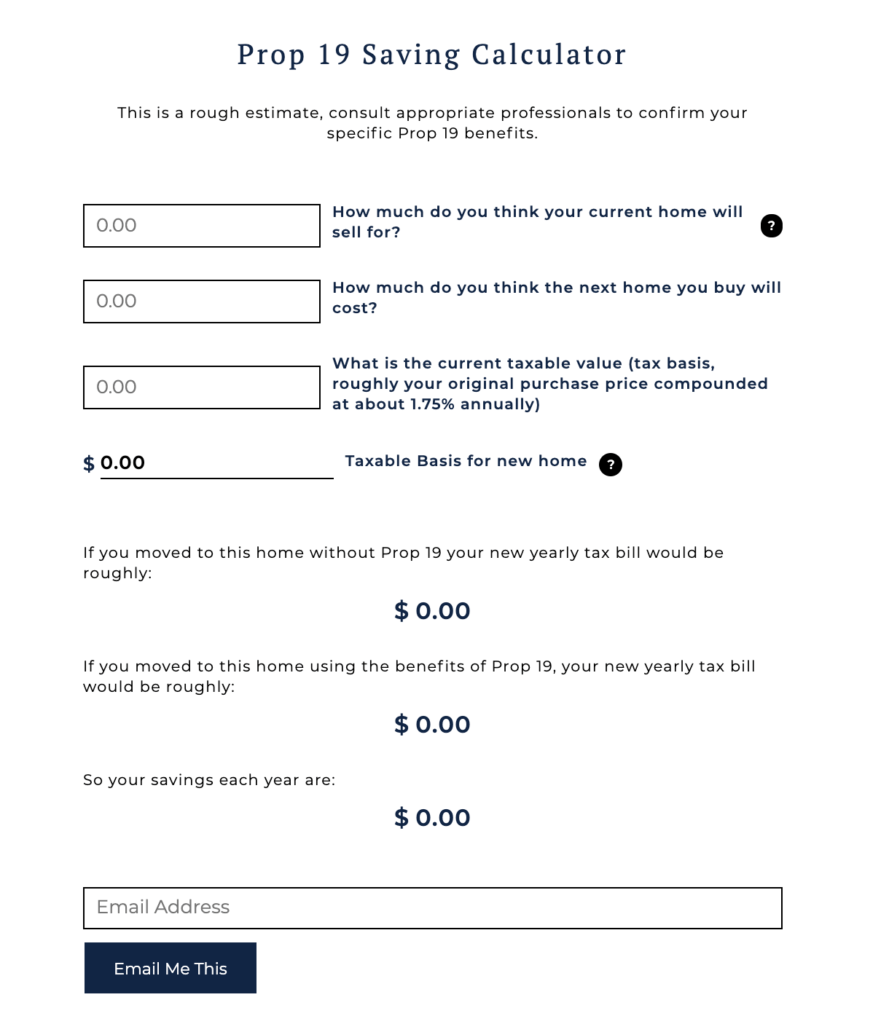

Prop 19 Property Tax Portability Arrives In California

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Portability Enabled Traditional Trusts Clark Trevithick Full Service Boutique Law Firm In Los Angeles California Southern California

Portability Of The Estate Tax Exemption Drobny Law Offices Inc

What Surviving Spouses Need To Know About The Marital Portability Election Natural Bridges Financial Advisors